The Eliasberg 1913 Liberty Nickel sold last week for $4.56M.

What does that mean to the numismatic marketplace?

Well, it’s certainly exciting that a mint produced ultra-rarity should come up for auction, and of course, it’s the single finest known. Anything that was part of Big Lou’s collection is a big deal, but the 1913 Liberty Nickel is particularly exciting.

Eliasberg 1913 Liberty Nickel, Obverse

It sold for opening bid at Stack’s Bowers – $3,800,000. On top of that, Stack’s Bowers collected $700,000 for handling the coin. Of course, they spent a small fortune safely storing, transporting, and marketing the auction event. Of course, establishing an agreement with the seller probably took a great deal of work. It was not one day’s work – it was the culmination of years of work.

Bruce Morelan and Laura Sperber (Legend) bought the coin back. Will Morelan hold on to it, or is this Dell Hansen’s simply efficient and predetermined path to purchase the coin without driving up the bidding?

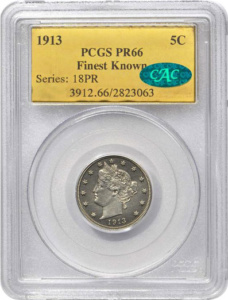

Eliasberg 1913 Liberty Nickel, PCGS / CAC

This is of particular interest because while the market generally reflects “the common coins stay common, the rare coins keep getting rarer”, this coin seemingly did not become more rare.

How much does the top of the market define the health of the overall coin market?

It certainly plays in to buyer sentiment.

This coin sold for over $1M (the first coin to do so) in 1996. In twenty years, were the coin “investment grade”, one would expect that it should have quadrupled in value in 20 years. It did not. The sale price in 1996 was $1.5M, and four times that is $6.5M. This coin did more than double in price, but either we could be amidst a trough for big coins.

In 1987, a Ferrari GTO sold for $1M. In 1989, the height of the market, a different 1963 Ferrari GTO sold for $14.6M. In 1994, that same car sold in 1989 sold for $3.5M. In 2014, that car sold for $38.1M. In 2018, one sold for $70M. Now these are all different cars, all with different conditions and pedigrees. There are considerably more Ferrari GTOs (35) than their are 1913 Liberty Nickels (5).

Eliasberg 1913 Liberty Nickel, Reverse

And now for something completely different. Interchange, the Willem de Kooning painting, sold for $20M in 1989. In 2015, it sold for $300M.

So what does all of this mean for the U.S. coin market? It certainly is a peculiar market.